34+ Monthly 401k withdrawal calculator

The calculator requires a total of seven inputs to determine. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

How To Do My Financial Planning Quora

At the end of Month 1 your balance will.

. 25Years until you retire age 40 to age 65. Expected Retirement Age This is the age at which you plan to retire. In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of.

We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. If you dont have data ready. Expected Retirement Age This is the age at which you plan to retire.

150000 will result in 87033 in interest earned at the end of Month 1. This retirement calculator is for retirement planning. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

A withdrawal savings calculator that optionally solves for withdrawal amount starting amount interest rate or term. IRA and Roth IRA. After 800 in withdrawals you will be left with about 70 in income.

Monthly 401k contributions 833. A withdrawal savings calculator that. Retirement Withdrawal Calculator Terms and Definitions.

The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement. Or withdrawals may be tax-free. 34 Monthly 401k withdrawal calculator Kamis 01 September 2022 Edit.

The benefits of most of these plans include a tax deduction on any contributions but the downside with all of these is the retirement withdrawals will be taxed as income. In some cases described below exceptio See more. Your employer needs to offer a 401k plan.

And from then on. Contributions and their subsequent interest earnings as part of a 401k plan cannot be withdrawn without penalty before the age of 59 ½. Use this calculator to estimate how much in taxes you could owe if.

Find out how much you should save using NerdWallets 401k Calculator. Amount You Expected to Withdraw This is the budgeted. Please visit our 401K Calculator for more information about 401ks.

You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. This withdrawal rate calculator can be used to estimate monthly and annual income in retirement. We designed the present savings withdrawal calculator to find the answer to all the above questions.

To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. When withdrawing your retirement savings from a 401 you can decide to take a lump-sum distribution take a periodic distribution buy an annuity or rollover the retirement.

How To Do My Financial Planning Quora

Why Is Financial Planning Important For Our Future Quora

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

2

2

2

Canada Rates Interest Retirement Fund Early Retirement Health Savings Account

2

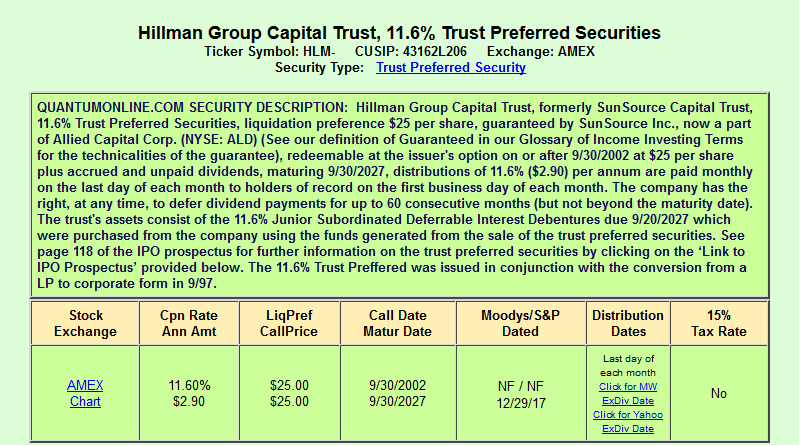

The Hillman Companies Smells Like Refinancing Nysemkt Hlm P Seeking Alpha

How To Do My Financial Planning Quora

Why Is Financial Planning Important For Our Future Quora

How To Do My Financial Planning Quora

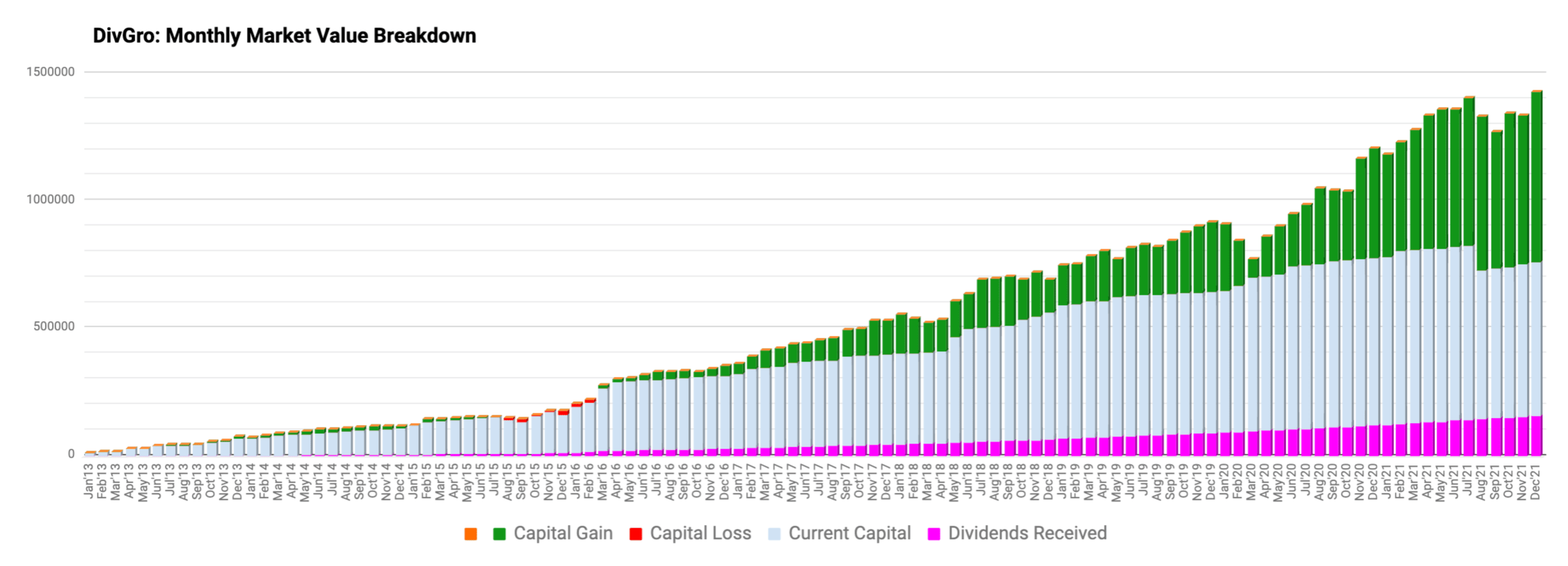

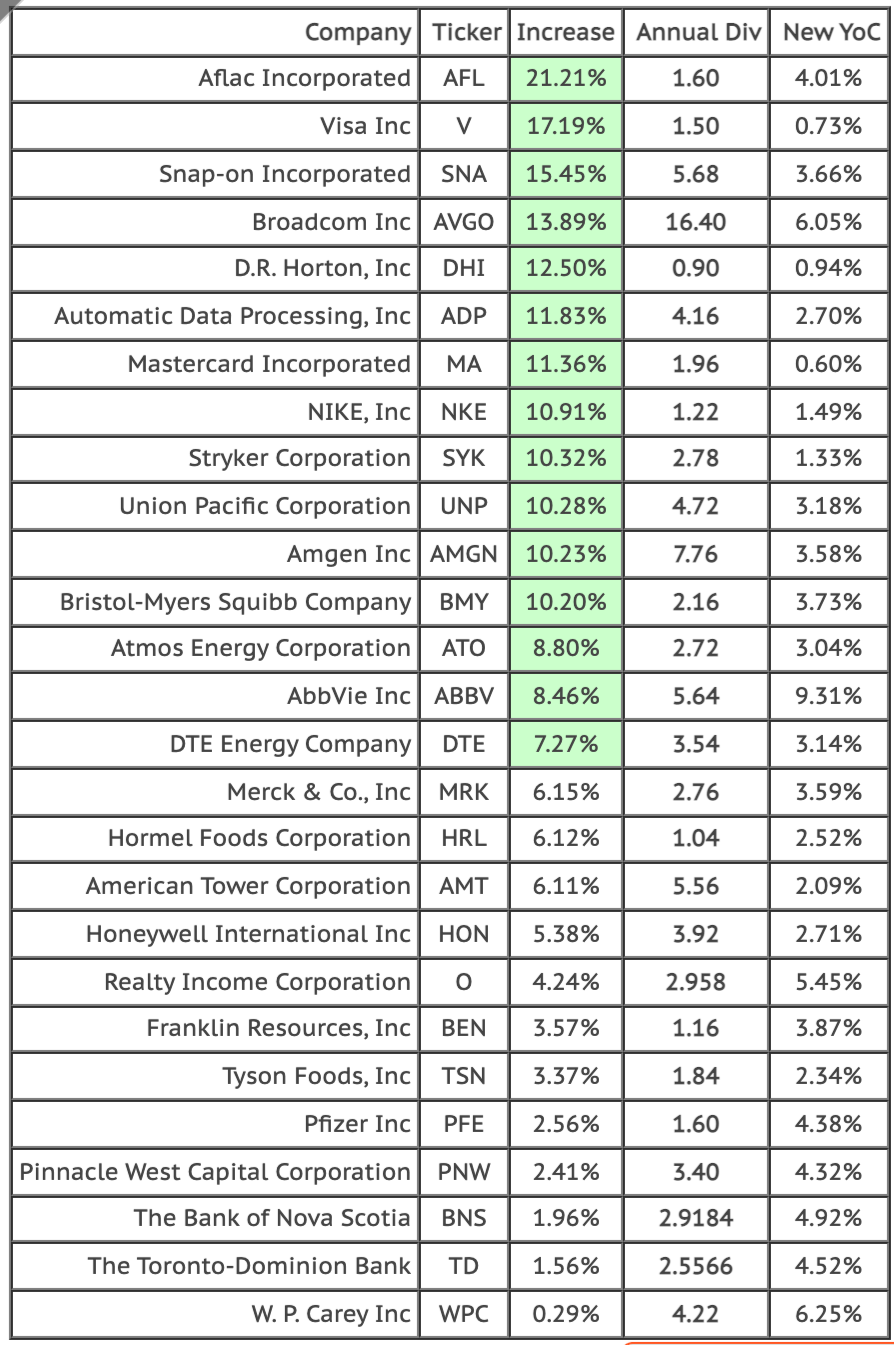

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Quarterly Review Of Divgro Q4 2021 Seeking Alpha

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement